HOT TOPICS LIST

- Strategies

- Stocks

- Buy

- Investing

- Brokers

- Psychology

- Interviews

- Accumulate

- Sell

- Hold

- Spotlight

- Websites

- Candlestick Corner

- Gold & Metals

- Options Trading

LIST OF TOPICS

PRINT THIS ARTICLE

by Steve Bentler

You can invest randomly, or you can develop a financial plan.

Is your investment portfolio working as hard for you as you worked to fund it? Are you following a reasoned, deliberate plan to meet your financial objectives, or is your portfolio a haphazard collection of assorted investments, randomly assembled with no clear direction in mind?

If you fit into the former category, congratulations! You're part of a rare breed. There aren't very many investors who take the time to develop a personal financial plan to guide their investment decisions, thereby dramatically increasing the odds of successfully attaining their goals. But if you fit in the latter category - well, you are not alone.

Steve Bentler

PRINT THIS ARTICLE

FINANCIAL PLANNING

Is Your Investment Portfolio Working Hard For You?

10/27/00 03:38:50 PM PSTby Steve Bentler

You can invest randomly, or you can develop a financial plan.

Is your investment portfolio working as hard for you as you worked to fund it? Are you following a reasoned, deliberate plan to meet your financial objectives, or is your portfolio a haphazard collection of assorted investments, randomly assembled with no clear direction in mind?

If you fit into the former category, congratulations! You're part of a rare breed. There aren't very many investors who take the time to develop a personal financial plan to guide their investment decisions, thereby dramatically increasing the odds of successfully attaining their goals. But if you fit in the latter category - well, you are not alone.

| Land ho! Unfortunately, most investors do not have a personal financial plan to guide them, and as a result, find themselves subject to every gust of economic change, blown to and fro like a ship without a sail. People in this group don't plan to fail - they just fail to plan! So how can you jump from a sinking ship onto solid bedrock, financially speaking? It's not hard; all you have to do is develop a personal financial plan that incorporates your own goals and objectives. You can do this either by enlisting the assistance of a professional financial planner or, if you are disciplined and so inclined, by tackling the financial planning process yourself. Does that sound like too big a job? It's not if you work at it, little by little. After all, it's your money, isn't it? You should be the final arbiter of how you invest it. This process could very well change the direction of your financial future. In coming issues, Working Money will examine principles of financial planning and investing that will help you in developing a personal investment portfolio. Even if you ultimately decide to use the services of a professional planner, this information will help you prepare for the process. |

| What is financial planning? So what exactly is financial planning? Personal financial planning is the process of taking inventory of your current financial position, determining your goals and objectives, and developing a coordinated plan of action to achieve those goals. In other words, your investment portfolio should be a reflection of your financial objectives. This strategic management of your personal financial concerns is subject to ongoing review and modification as financial objectives, family and business circumstances, and economic conditions change. When these changes occur, as they did earlier this year for many investors in the markets, you should take the time to review and modify your investment portfolio to reflect them. But how can you develop this personalized plan that will help you build your portfolio to meet your objectives? A quick review of the financial planning process will give you a sound foundation with which to develop such a plan and assist you in building an appropriate investment portfolio. The financial planning process The financial planning process (Figure 1) can be divided into six separate steps: (1) Establishing personal financial goals and objectives In the coming months, Working Money will review each of these steps in greater detail. |

|

| Figure 1. The six steps to financial planning. |

| |

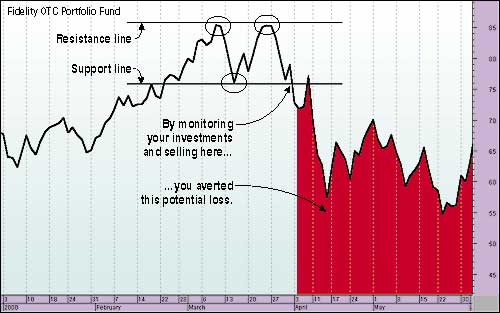

| Once you have successfully navigated your way through the initial steps of the financial planning process, you will have answered several basic questions: What do you want? When do you want it? How much do you want? What resources do you have available to meet those objectives, and what additional resources are needed? And finally, what requirements or limitations (risk tolerance, family obligations, and so forth) will dictate how you proceed? These questions will be answered in a way that will not only guide you in selecting appropriate investments (not to mention risk management vehicles, basic tax strategies, and employment decisions, as well as others), but also help you monitor and adjust your portfolio in response to changes that might come down the road, such as the recent, precipitous drop in the stock market (Figure 2).  Figure 2: Daily chart of the Nasdaq Composite Index. Here's a classic example of a double-top formation preceding a major market correction, a clear warning to those monitoring their investments. Finally, guided by your plan and armed with information from Working Money (and Technical Analysis of STOCKA & COMMODITIES magazine for the more technically minded investors), you will be able to monitor and adjust your portfolio as needed. Future Working Money articles will discuss how to utilize technical analysis, a form of market analysis, to make your investment decisions easier. You will learn about line studies, such as support and resistance lines and about basic patterns to watch for, such as the picture-perfect double-top formation seen in March 2000 in the Nasdaq Composite Index (Figure 2). Armed even with this simple information, you will have the necessary tools to recognize the looming downturn in the market, enabling you to move your stock portfolio from one deteriorating sector to a more stable one, thereby nailing down the profits you make. For example, say you had invested in the Fidelity OTC Portfolio Fund (Figure 3) on January 1, 2000, because you had heard that the small-cap sector (a group of stocks of smaller companies) was hot. This mutual fund (a professionally managed portfolio of stocks) was participating in those gains as well, appreciating around 36% the last three months of 1999 alone! But in March, say you observed that the rising share price of the fund stalled and then fell, only to go back up to the stock's previous high. This was only temporary, though, and the share price began to plummet. Looking at the fund's chart (Figure 3), you saw what is known in technical analysis jargon as a double-top formation, raising a major red flag for you and prompting you to investigate.  Figure 3: Fidelity OTC Portfolio Fund. This fund closely tracked the Nasdaq Composite Index earlier this year. Observe the double-top formation prior to the dramatic market correction. Monitoring your portfolio and making appropriate adjustments would have enabled you to keep more of your gains. |

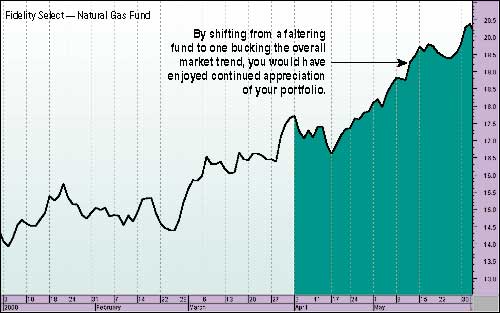

Armed with this information, you would have been able to bail out of the fund at the end of March with most of your gains intact (a 6% gain), moving your capital to a mutual fund in a different sector, in this case the Fidelity Select-Natural Gas Fund (Figure 4). This fund, and other mutual funds in the energy/natural resource sector, sailed through the tempest of the major market correction. By the end of May, your investment would have gained an additional 18%. Figure 4: Fidelity Select-Natural GAS FUND. This fund, like many in the energy/natural resource sector, actually appreciated in the same period that the broader market lost about a third of its value. Moving out of a stumbling fund into a rising fund would not only have prevented a loss, but also created further gains. But - and this is a major but - if you hadn't monitored your portfolio or repositioned your investment, you would have lost not only your gain, but also some of your principal (on paper) before the fund finally turned around. By the end of May, you would have only been back to the original investment you made five months earlier (Figure 3) - nothing much to boast about! By knowing what to do and when to do it, you would have not only survived the bearish dip in the market, you would have thrived in it and increased your profit. |

| By properly following all the steps of the financial planning process (including the crucial step of reviewing your investment decisions on an ongoing basis), you will have the satisfaction of knowing that your portfolio is indeed working as hard for you as you worked for it! |

| Title: | Working Money Writer |

| Company: | Technical Analysis, Inc. |

| Address: | 4757 California Aveenue SW |

| Seattle, WA 98116 | |

| Phone # for sales: | 206 938 0570 |

| Fax: | 206 938 1307 |

| Website: | www.traders.com |

| E-mail address: | SBentler@traders.com |

Traders' Resource Links | |

| Charting the Stock Market: The Wyckoff Method -- Books | |

| Working-Money.com -- Online Trading Services | |

| Traders.com Advantage -- Online Trading Services | |

| Technical Analysis of Stocks & Commodities -- Publications and Newsletters | |

| Working Money, at Working-Money.com -- Publications and Newsletters | |

| Traders.com Advantage -- Publications and Newsletters | |

| Professional Traders Starter Kit -- Software | |

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog