HOT TOPICS LIST

- Strategies

- Stocks

- Buy

- Investing

- Brokers

- Psychology

- Interviews

- Accumulate

- Sell

- Hold

- Spotlight

- Websites

- Candlestick Corner

- Gold & Metals

- Options Trading

LIST OF TOPICS

MARKET COMMENTARY

Hang On! We're In For A Bumpy Ride

07/28/01 12:15:58 PM PSTby Ron L. Ellison

Hang On! We're In For A Bumpy Ride

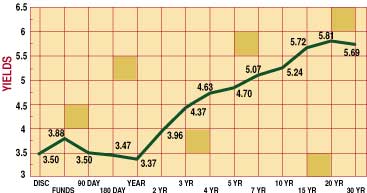

In May 2001, the Federal Reserve wielded its monetary ax again, lopping off another 50 basis points and pushing the Fed funds rate down to its lowest level since April 1994. Where does that put the economy? To answer this question, you need to look at the big picture. Corporate profits are down. Energy prices are up. Retail sales remain surprisingly strong amid falling productivity. Slower growth concerns are juxtaposed against growing concerns about a sharp upswing in inflation. The personal savings rate is lower than a duck's belly. And somewhere out there, a pending tax cut awaits. THE ECONOMIC PICTURE Last year, we witnessed the fall of the technology sector. Now, it looks as if the real estate sector will follow suit. Whenever you read about real estate agents working harder, holding more open houses, and scheduling more meetings with sellers to establish more realistic prices, it's time to strap on the old safety belt, because we may be in for a wild ride again. In California much of the market is 15-20% overvalued, and it's only a matter of time before prices start weakening throughout the state. In Austin, TX, houses that once sold for a cool million now list for a measly $600,000, as home sales there have slipped for half a year. Yes, the signs are there and they cannot be ignored. And the steep yield curve the Fed is engineering isn't going to help any. Mortgage rates are tied to the 10-year section of the curve, not the short end. Further, the Treasury continues to tap the budget surplus to retire 30-year bonds. This latest incursion to retire long-term debt was the ninth so far this year. Such buy-ins can put an artificial cap on supply. How steep the yield curve would be otherwise is anyone's guess. Conventional wisdom continues to cite consumer spending as holding the economic keys. Conventional wisdom, however, is frequently wrong. The key to this economic slowdown/recession and any meaningful recovery is perhaps capital expenditures, something that unfortunately isn't assigned an appropriate weight in the overall picture. Domestic capital expenditures led the economy (particularly information technology spending) in the late 1990s until the Nasdaq tanked. Goldman Sachs recently published a report noting that spending on software and hardware for the last 10 years increased at 13% per year. Thanks to the Y2K craze, however, spending accelerated 21% in 1999 and 25% in 2000. Now, of course, the picture is reversed. Goldman Sachs expects information technology (IT) spending in the US to decline by 18% and only recover to low single-digit growth in late 2002. So the outlook for a sharp recovery in IT spending, irrespective of what the Fed does, is just not there.

The worse the economy gets, the more aggressively its monetary authorities -- that is, the central bankers -- will react. At least, up to a point. It took Fed chairman Alan Greenspan and his banking buddies 11 months (June 1999 to May 2000) to crank up rates 175 basis points. They have now taken all that back plus another 50 points in five short months. Not only that, it looks as if the European central bank (ECB) is in an easing mood. After months of being labeled "stubborn" and "behind the curve," the ECB and its leaders finally shouted uncle, dropping interest rates 25 basis points recently in a surprise move. Closer to home, the Mexican central bank recently cut rates after a three-year cycle of tightening. The bank cited a better than expected outlook for inflation. The rate reduction pushed the peso below nine per US dollar for the first time in three years, increasing the peso's value against the dollar. Mexico attracted foreign investments such as Citigroup's big $12.5 billion purchase of Mexico's largest bank, Banucci, threatening to send more dollars south of the border, further depreciating the dollar against the peso. Mexico has become a Wall Street darling of late and is considered a safe haven. Brazil faces political and economic uncertainty based on charges of political corruption. Contributing to Argentina's problems was the devaluing of Brazilian currency last year, thus weakening investor confidence and the Mercosur trade agreements. In the long term, this is inflationary. Argentina has the most emerging-market foreign debt in the world market, and a default would be no small thing. In comparison, Mexico looks good. What all this means is just this: the monetary sluice gates are being opened in an effort to reflate the world economy. And reflation carries with it the seeds of inflation. PROBLEM AREAS Here in the US, private and public debt is now approaching 7% of Gross Domestic Product (GDP). In short, spending exceeds income or earnings. The counterbalance is the support that comes from foreign investments and the concept of a budget surplus. Both could and may very well suddenly disappear one day. There is already talk about President George W. Bush's tax cut and spending programs having a hit on the surplus, and many investors see Jim Jeffords' defection from the Republican party, giving control of the US Senate to the Democrats, as a portent of more federal spending.

Another concern is credit problems. According to some, they appear to be spreading from bigger banks to smaller lenders. First-quarter earnings reports showed an upswing in problem loans at many smaller institutions. How will a slowdown lead to higher prices and inflation? In the short term it won't. But in the longer, more intermediate term -- well, that's another matter. Markets discount the future; witness the performance of gold mutual funds so far this year. Most are up nearly 14% to date as the precious metal broke above $291 an ounce, the highest price in nearly a year. Now, gold staged a rally at the same time the US dollar index was moving to new highs. This isn't supposed to happen; gold doesn't usually do well when the US dollar is strong because it's an inflation hedge. Gold stocks move up ahead of the price of the bullion. That gold is getting any play at all suggests two possibilities: first, it's probably bottomed out; and second, at least some investors are getting nervous. Just how long is the intermediate term? Probably mid- to late 2002 or early 2003, but that depends on the speed and aggressiveness of the reflation. BEWARE OF THE SUNSHINE CROWD The media is fraught with comments from those suggesting the market leaders, mostly techs, will recapture the lead if and when the market correction occurs. These pundits suffer from a severe case of wishful thinking. My thesis is basic: Most of us realize that the only certainties in life are death and taxes. There is one more -- the actions of central bankers. Central bankers almost always do the right thing at the wrong time. Don't be surprised if all central bankers who sold off (and continue to sell) gold come to rue the day. Nor should you be shocked if Japanese equities outperform their US counterparts during this decade. Finally, don't be surprised when the dollar, like any obedient Fido, finally rolls over. THE ACTION OF THE DOLLAR Since its trough in the low 80s in 1995, the dollar index has risen to the 115 level. From 1995 to the end of last year, the US enjoyed three things rarely seen at the same time in any economy -- rapid growth, high real interest rates, and low inflation. Even celebrity chef Emeril Lagasse would have a tough time devising a better recipe for a strong buck. But falling interest rates coupled with rising prices are never kind to financial assets, especially those that spell savings. So like real estate, the dollar is top-heavy by 15% to 20%. Never at a loss for explanations about stock market gyrations, stock jockeys claim capitulation occurred when the Nasdaq bottomed earlier in 2001. I have a slightly different view. With the European central bank tossing in the towel and joining the reflation crowd recently, easier money and lower taxes are now a global trend. However, all this reflation could turn into the economic bladderbuster that few could have predicted. None of this is intended to sound the tocsin of doom. To paraphrase John Maynard Keynes, nine times out of 10 the extremes of misfortune never occur. But that's hardly an excuse to drive around for long with a flat spare tire in the trunk. Managing assets (money) is about managing risk (yes, as most have discovered this past year, if they didn't already realize it, markets have risk). And managing risk is about being open to the unexpected. Reflation is a huge no-no. Ron L. Ellison is a registered investment advisor and financial planner with RLE & Associates, Newport Beach, CA 92660. He can be reached at 949 261-1740, 877 455-9681, or RLEasset@aol.com. Current and past articles from Working Money, The Investors' Magazine, can be found at Working-Money.com.

Copyright © 2001 Technical Analysis, Inc. All rights reserved. |

Ron L. Ellison is a registered investment advisor and financial planner with RLE & Associates, Newport Beach, CA 92660.

| Company: | RLE & Associates |

| Address: | 3975 Birch ST. |

| Newport Beach, CA 92660 | |

| Phone # for sales: | 949 261-1740 |

| E-mail address: | RLEasset@aol.com |

Traders' Resource Links | |

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog